SolomonEdwards has over two decades of proactive, concrete experience in supporting a broad range of top-tier clients with their acquisition integration needs. Our experience ranges from early-phase analysis to post-integration evaluation. SolomonEdwards has proudly been involved in over 75 national and global Integration efforts. We have played multiple roles in most of them, including, but not limited to, the following service areas:

- Conduct Due Diligence

- Plan for Pre & Post Closing Integration Planning

- Set up / run IMO (Integration Management Office)

- Day 1 Execution

- Value Realization Planning & Monitoring

- Lead Workstreams and serve as Integration leads

- Guide Data Strategy & Insights

- Direct Change Management efforts

- Lead Communications efforts to employees, customers, shareholders, and other stakeholders

- Conduct Business Process Integration / Transformation

- Provide Interim CFO Services

- Direct overall Finance Transformation

- Assist with Transaction Accounting & Financial Reporting

- Execute System Integration & Optimization efforts

- Implement Accounting & Financial Reporting changes

- Perform Post integration value realization analysis

- Provide Subject Matter Experts and other resources

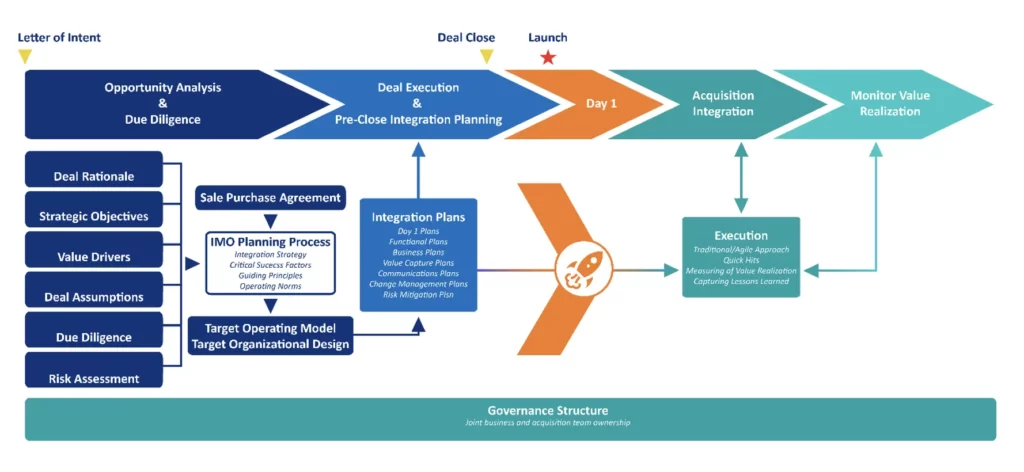

Acquisition Integration Framework

Integration or non-integration strategy

Approach

It is paramount to clearly define how the deal connects to the overall deal strategy and value realization.

- Define integration strategy during the planning phase and definitely before Day1.

- Secure champions

- Define value realization metrics

Options

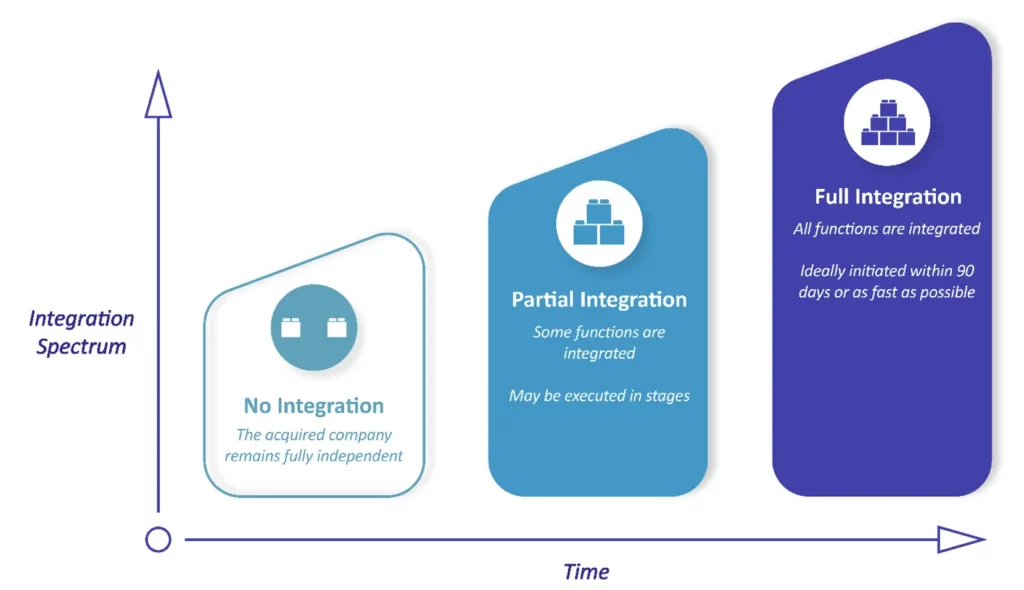

There’s no one right way; each approach delivers a unique degree of post-acquisition autonomy.

| • The acquired company remains fully independent | • Some functions are integrated | • All functions are integrated |

| • Maybe executed in stages | • Ideally executed within 90 days or as fast as possible |

Traditional vs. Agile Approach

Find the right balance between a traditional and agile approach to align with value drivers.

Pros of a Traditional M&A Playbook |

Agile Approach |

|

|

Cons of a Traditional M&A Playbook |

Agile Approach |

|

|